| Correlation |

Correlation of trading system's returns.

Following code shows how to get a correlation table of several trading systems.

Correlation is calculated from equities returns.

Correlation

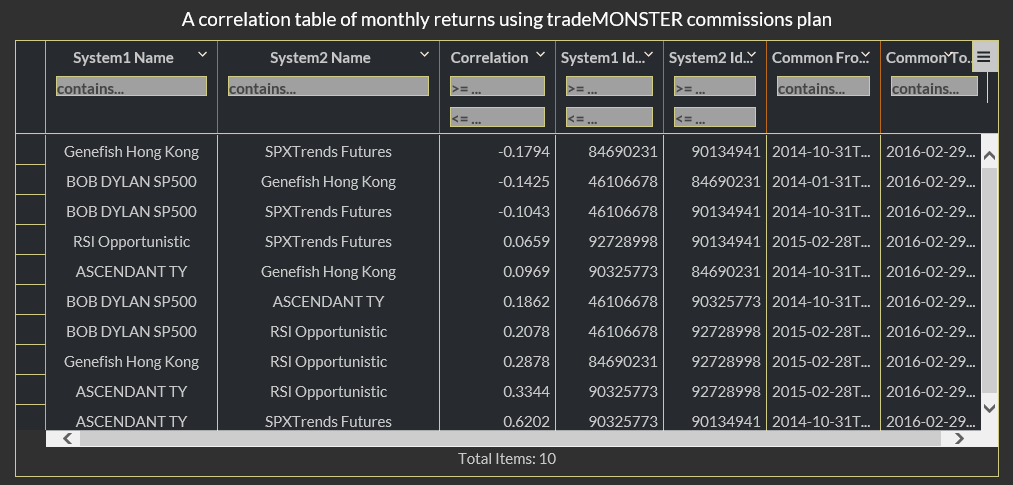

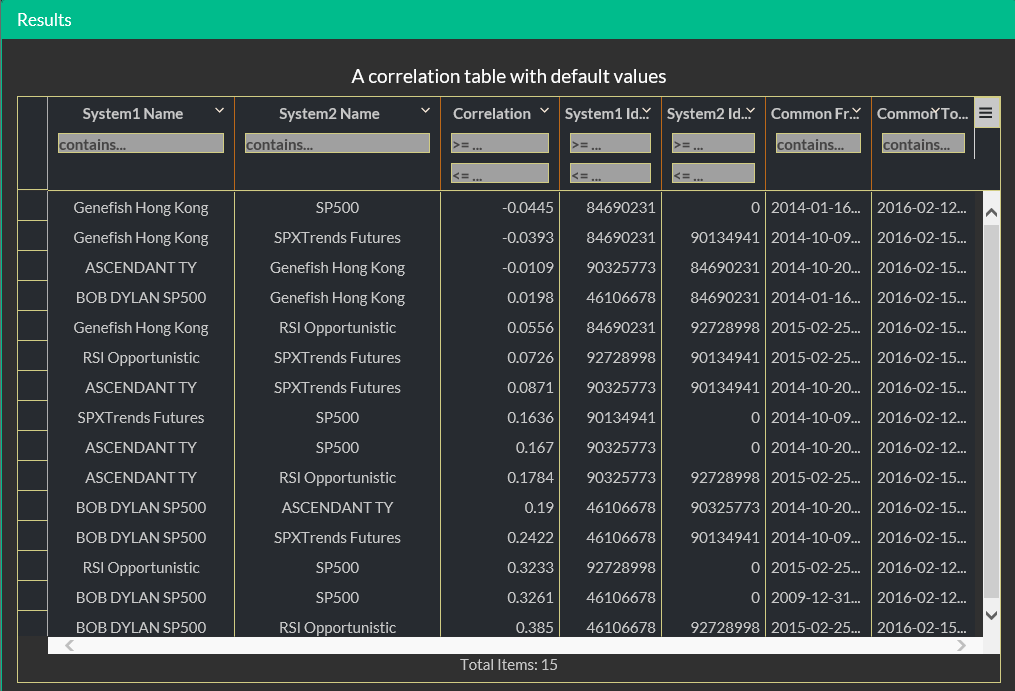

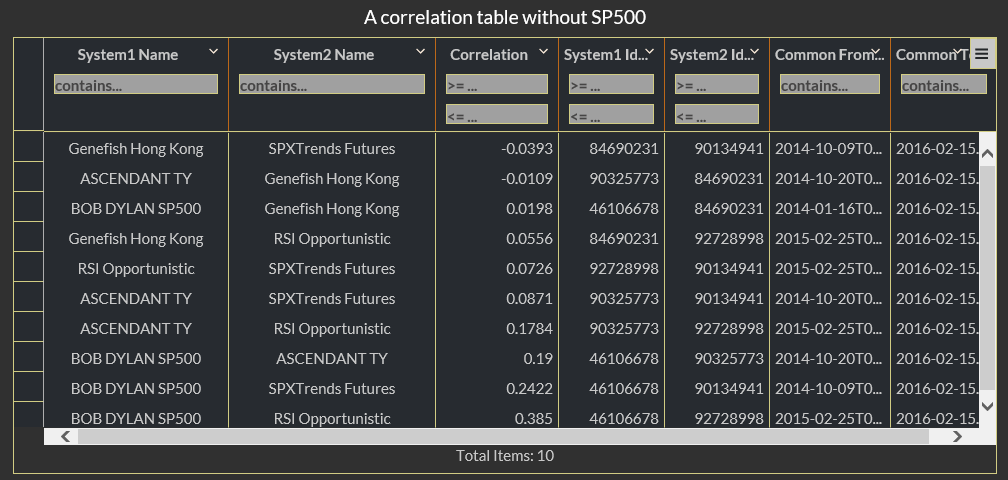

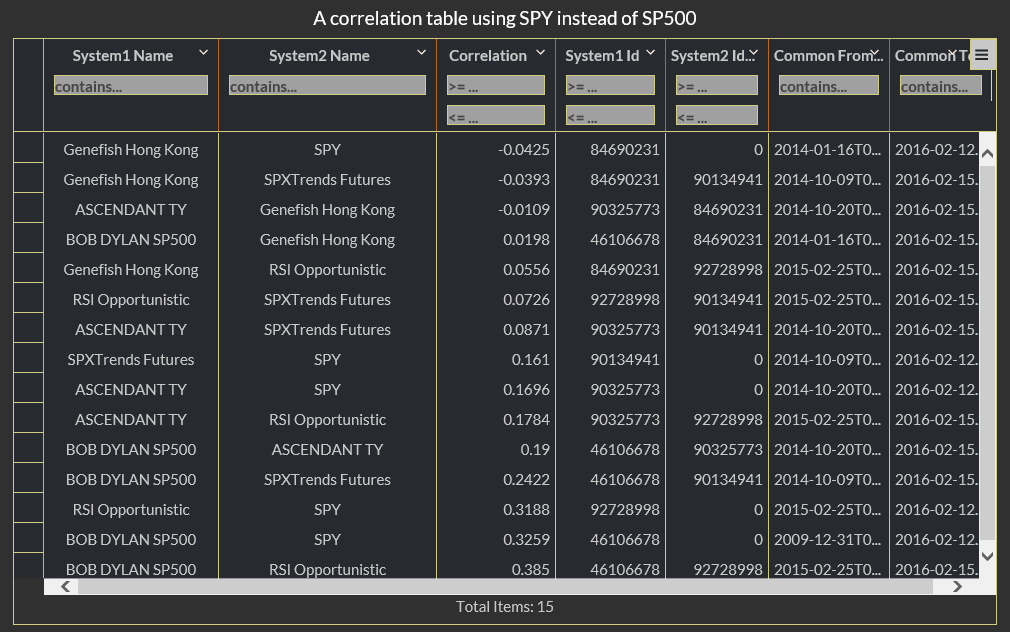

/* Disclaimer: The systems used in this example were selected randomly. Data shown in this example can contain errors.*/ Int64[] systems = new Int64[] { 46106678, // Bob Dylan 90325773, // Ascendatnt 84690231, // Genefish Hong Kong 92728998, // RSI Opportunistic 90134941 // SPXTrends Futures }; H4 = "A correlation table with default values"; TABLE = GetCorrelationTable(systems); H4 = "A correlation table without SP500"; TABLE = GetCorrelationTable(systems, null); H4 = "A correlation table using SPY instead of SP500"; TABLE = GetCorrelationTable(systems, "SPY"); H4 = "A correlation table of monthly returns using tradeMONSTER commissions plan"; TABLE = GetCorrelationTable(systems, null, TimeInterval.Month, "tm"); H4 = "Include SP500 index to the above setup"; TABLE = GetCorrelationTable(systems, "SP500", TimeInterval.Month, "tm"); H4 = "Use other symbol for correlations. For example \"QQQ\"."; TABLE = GetCorrelationTable(systems, "QQQ", TimeInterval.Month, "tm");

Correlation Default

Correlation without SP500

Correlation with SPY

Correlation with Parameters