|

Recent Changes and Additions:

July 31, 2014: Added optional parameter &cancelparked to cancelallpending command.

|

Overview

Many traders use computer programs to place trades. To accommodate these traders,

Collective2 makes available a Signal Entry API. All calls to

this API are accomplished through HTTP, by having your

program call a URL.

Who can use it

Using the Signal Entry API is easy. Your software

needs to be able to access a Web URL. (It needs to be able

to 'GET' a Web page.) This is a trivial

matter in Perl, C++, or VB. If you need assistance with

this, please post a message on our Forums; I'm sure

you will be able to get help from one of our geeky members.

Note that you can manually test this interface by simply

typing a Web address into your browser. This will allow you

to see how the system works.

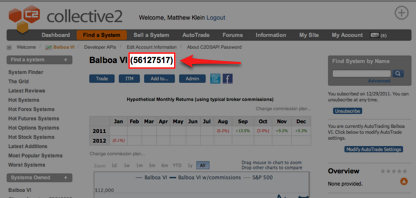

How to create the URL

Before you begin, you'll need to have created at least

one trading system on Collective2. You'll need also to know

the system id of the trading system for which you want to

place a trade. (Every system on Collective2 has an unique id

number associated with it. This is visible to the system

owners when they visit their "System Details" page

on Collective2.)

|

|

|

|

|

|

Above: you will find

your system's id on the system details page. The

number is not meant to be secret, but it is

displayed only when you are logged in as the

system's owner. |

|

|

|

|

|

The strategy for using the Web interface is as follows.

You will code a web address (URL) which contains all the

information necessary to place a trade. Unless you specify

otherwise, the trade will become valid immediately, and also

will be emailed (or Instant Trade Messengered) to

subscribers immediately.

The URL is in the following format:

http://www.collective2.com/cgi-perl/signal.mpl?[PARAMETERS]

Placing an order

The required parameters are:

| Parameter |

Value or Example |

What it Means |

Comments |

| cmd= |

signal |

|

|

| systemid= |

123456 |

The system ID displayed as above. |

|

| pw= |

loginPassword or (preferred) C2 Data Services password |

case sensitive |

| action= |

BTO |

Buy To Open |

open a long position |

|

SSHORT |

Sell Short |

used for stocks |

|

STO |

Sell To Open |

used for non-stocks |

|

BTC |

Buy To Close |

close a short position |

|

STC |

Sell To Close |

close a long position |

| quant= |

100 |

Number of shares or contracts

Note: for forex, use the number of minilots (10,000 cus). Example: submitting "Buy 2" EURUSD will effectively buy 20,000 Euros. |

| dollars= 3500

|

Optional. May be used instead of quant.

For stocks only, you may submit a dollar value, which will be translated into a number of shares. Price used may be delayed. If order submitted when market is closed, the last trade price from the previous day will be used to calculate shares, not the next day opening price. |

| instrument= |

stock |

Note that ETFs like

QQQ and DIA are traded on a stock exchange and thus

are considered stocks. |

| |

option |

|

|

| |

future |

|

|

| |

forex |

|

|

| symbol= |

IBM |

|

You can find C2 Symbols here. |

| limit= |

35.06 |

|

Only use if this is a limit order. |

| stop= |

20.10 |

|

Only use if this is

a stop order. For market orders, do not use either

stop or limit parameters. |

| duration= |

DAY |

Day Order |

|

| |

GTC |

Good Til Cancel |

|

The table above outlines the basic URL format. Here are

two examples to demonstrate.

|

You want to buy 1200 shares of IBM at the market. |

|

|

|

Your program calls the following URL

(all on one line): |

|

|

http://www.collective2.

com/cgi-perl/signal.

mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=stock&action=BTO&quant=1200&

symbol=IBM&duration=DAY |

|

|

|

|

You want to buy 5 contracts of the December 2011

E-Mini S&P at limit 1120 or better, good til

cancel. (For help with futures symbols, see this page.) |

|

|

|

Your program calls the following URL

(all on one line): |

|

|

http://www.collective2

.com/cgi-perl/signal.

mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&limit=1120&duration=GTC |

|

After you or your program calls the URL, the Web site

will respond either with an error message, or with data

similar to the following:

<collective2>

<signalid>10344682</signalid>

<comments>Signal 10344682 accepted for immediate

processing.</comments>

</collective2>

This pseudo-XML text is designed so that you can more easily extract

the unique signal ID which is assigned to your request.

Every trading signal on Collective2 is given an unique

signal id.

Knowing the signal id of the trade you enter is useful

for more complex trades, like conditionals and OCA orders. In

addition, it is required when you want to cancel an order.

Using your own signalids

Every order on Collective2 has an unique signal id. The

easiest way to use the Signal Entry API is to place an order

using the ?cmd=signal parameter, as described above, and

then allow C2 to assign your signalid. Your software can

read the signalid sent back in the <signalid> node

(see example above). This signalid can be used for order

cancellation, creating conditionals (described below), and

creating OCA groups (described below).

In the example above, C2 assigned your order a signalid.

However it may be easier to use your own signalids when

creating an order. There are a few important things to note

about this. First, if you create your own signalid, you must

guarantee its uniqueness within your own trading system,

across eternity. Once you specify a signalid, you must not

use it again -- even years later -- and even if the original

order in which the signalid appeared has been

canceled, expired, etc.

To specify your own signalid, simply submit your signal id

numbers along with the order. For example:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&signalid=100

Thereafter you can use your own signal ids to cancel

orders and build conditionals.

If you specify a signalid, it must be a positive integer

that is greater than zero and less than or equal to

4294967295.

(Note that you are not required to submit your own

signalid. If you do not submit one, the server will generate

one for you.)

Conditional Orders

A conditional order is an order that does not become

valid until a preceding order is filled. This is useful, for

example, if you want to set a good til cancel stop loss, but

only after an initial order is filled first.

To place a conditional order, add the following parameter

to your URL:

&conditionalupon=100

Example:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=STC&quant=5&

symbol=@ESZ1&limit=1500&duration=GTC&conditionalupon=100

In the example above, you are saying, "Place the

following Sell To Close Limit Order... but only after

SignalID=100 has been executed. Until signalid has been

filled, this order should not be placed."

Reversal Orders (the hard way)

If you are long an instrument, and you want to go short

(or vice-versa) that is called a reversal. In order to

facilitate AutoTrading your C2 system, C2 insists that

reversal be accomplished in two steps: first you must send

an order to close the open position. Next you must send an

order to open the new position.

Example 1: You are long 100 shares of IBM. You

want to reverse at the market, so that you end up short at

the market. You must therefore issue two commands in

sequence:

STC 100 IBM @ MKT

STO 100 IBM @ MKT

Example 2: Your are short 2,000 EUR/USD, which is

trading at 1.1234. You want to reverse your position and go

long if the EUR/USD falls to 1.000.

This is best accomplished as a conditional order like

this:

BTC 2,000 EUR/USD at limit 1.000

conditional order: BTO 2,000 EUR/USD at MKT (when

order above fills)

Reversal Orders (the easy way)

If you would rather have C2 handle the complexities or

reversal orders, you can use our one-step reversal command.

The most simple format is like this:

?cmd=reverse&symbol=EURUSD ...

The command above will simply flip your current position

from long to short, at the market price, immediately. You

can specify additional parameters if you like. The most

useful of them is a "triggerprice" at which the

reversal should take place:

?cmd=reverse&symbol=EURUSD&triggerprice=1.000

...

Here are the reversal-related parameters you can use:

cmd=reverse (required)

symbol=SYMBOL (required)

triggerprice=price (optional)

duration=DAY/GTC (optional; will be GTC unless

specified)

quant=new opening quant (optional; use only if

you want your final position to be a quantity different

than your prior quantity; if not specified, you will go

from long to short, or short to long, using the same

quantity of position before the reversal)

OCA Groups

You can specify that a group of trades act as a

One-Cancels-Another (OCA) group. The definition of an OCA

group is this: as soon as the first order within the group

is filled, the remaining orders within the group are

cancelled.

To make an oca group, you need to specify the ocagroupid

with each signal you enter. The ocagroupid is an unique

number. You can either specify your own ocagroupid, or can

request one from the C2 server.

To request an OCA id number, send the following command:

?cmd=requestocaid

You will receive the following response:

<collective2>

<ocaid>17195788</ocaid>

<status>You may use the ocaid above when adding new signals.</status>

</collective2>

You can then use this OCA id when placing trades. Just

add the OCA id to each trade signal URL, as in the following

example:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&ocaid=12345

Alternately, you can simply manufacture your own unique

never-to-be-used-again ocaid.

Obviously, for an OCA group to function properly, more

than one signal will need to be identified with the OCA id.

Once a group of 2 or more orders are entered using the same

OCA id, the first trade that gets executed will immediately

cancel the other trades within the OCA group.

Before this latest feature, you were required to send (1)

your entry order, (2) your stop loss, and (3) your profit

target as three separate orders. If you wanted to do

everything perfectly, you were required to make your stop

and profit-target conditional upon the entry order being

filled, and also to make the stop and profit target a single

OCA group.

That was a lot of API drudgery for a common task. So we

developed an all-in-one order entry.

Essentially, you enter your order as shown above, but you

can tack on one or both of the following:

&stoploss=xxx

&profittarget=yyy

If you enter both a stoploss and a profittarget, the two

exit orders will automatically become a One-Cancels-Another

(OCA) group. That way, if you exit a trade at the profit

target (for example), your stoploss order won't be left

lying aroun.

Here's an example:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESU6&limit=1000&duration=GTC&stoploss=900.50&profittarget=1200

Update:

November 13, 2007: &forcenooca=1

When you create an order with a stop loss and

profit target all-in-one, you are creating one parent order

(the entry order) and two conditional (children) orders.

(The children are the stop loss and profit target.)

As a convenience, C2 will automatically make the two

children a One-Cancels-Another (OCA) group. This means that

if either child is filled or cancelled, so too is the other

child.

However, there are cases where this convenience is most

decidedly not a convenience. In particular, in cases

where a system will often cancel and then replace a

stop-loss or profit target, it is annoying that this action

will affect the other unrelated child order.

So you can specify &forcenooca=1 whenever

you submit a signal. This will prevent an OCA group from

being created automatically. While OCAs are only created

automatically in cases where both profittarget and

stoploss are included in one single API submission, there

is no harm in including the &forcenooca=1 in

all cases. It will simply be ignored in instances where it

is not applicable.

Advanced Topics

Relative Orders

C2 allows you to enter trade signals without knowing the

specific price of the instrument at the time you place the

orders. For example, you can specify that an order be placed

after the market opens, based on whatever the opening price

turns out to be. In this example, your order would look

something like "Sell To Open at OPENING PRICE -3

Stop"). In addition, you can set your profit targets

and stop losses based on whatever your initial fill price

turns out to be. So, for example, your order would look

something like this: BTO 1 IBM @ market, profit target=ENTRY

PRICE + 5, stop loss=ENTRY PRICE -2.

To learn more about "relative orders" such as

these, please see this

page.

Relative orders are also available through the API. The

URLs needed to encode them can be somewhat complex, so this

feature is meant for advanced users. This feature can best

be shown through an example:

Let's go through the example, piece by piece. First,

obviously, we provide system credentials (system id number

and password). Next we specify the opening portion of the

order: we will Buy To Open 1 electronic Soybeal Meal, at the

upcoming market open, at a limit price that is based on

whatever the market opens at.

Note that we do not know at what price the SM market will

open. But we can specify that our entry order will be at the

market opening price plus 66 points (or, O+66). A human

being would be tempted to write: O+66 but unfortunately web

services will puke at the "+" plus sign. We need

to "encode" all plus signas as the following

string: %2B ... in other words the phrase:

limit=O+66

becomes

limit=O%2B66

No such similar encoding is needed for minus signs.

Now let's continue reviewing the example above.

We are specifying that we want to enter the SM market at

a limit price of O+66. We could stop there, if we wanted,

but let's imagine that we also want to specify a profit

target and stop loss in the same command. Of course, our

stop loss and profit target will be based on the actual

trade price we receive in the opening order... which we

don't know yet. But that is not problem. We can represent

the opening trade price with a T.

So the last part of our string says:

Set a good-til-cancel stop loss and profit target as

follows (these are good-til-cancels because of the phrase

"&targetTIF=GTC"):

profittarget=opening trade price + 55

stoploss=opening trade price - 4

Whenever you use "relative orders" you can

specify one of three relative order types:

O --> represents the session opening price (be

careful of electronic contracts, as the opening of the

session is often the "night" before the main

trading day)

T --> represents the fill price of the opening

portion of the trade. This implies you can't use T+ or T-

orders for BTO or STO, since no open has been executed.

Q --> represents the real-time quote-feed price of

the instrument at the moment the order is released for

processing.

Keep in mind that you can add &parkuntildatetime

parameters to your opening order, which will allow you to

specify an order in advance of the time you want it

released. &parkuntildatetime is explained further below.

Delaying Signal Processing

As you can see, trading signals need to be entered one at a

time. Given this fact, you may wish to delay the processing of

groups of signals until the entire group is entered. Why would this be?

Well, for example, you may not want to confuse your

subscribers by sending them two trading signal emails in

rapid-fire succession (which is what will happen by default,

when you enter one signal after another.) Or, more

important, you may not want your first trading signal to be

"accidentally" traded until you are sure that your conditional order is in

place.

Solving this is simple. You can enter an optional

parameter when you construct your trading signal URL. It is delay=X, where X is the number of seconds you want to delay

a signal before processing it.

To illustrate, let's modify our second example URL from above.

Let's say you want to enter an order to buy 5 contracts of

the E-Mini S&P at limit 1120, but you don't want the

signal to be immediately traded. Also, you don't want the

signal to be immediately emailed to your subscribers,

because you would prefer to wait until you have entered

other signals first. Then, once all of your signals are

entered, you will send one email to each subscriber, containing

the batch of signals.

Here is the modified example URL, incorporating this

delay parameter:

|

|

|

You want to buy 5 contracts of the

E-Mini S&P at limit 1120 or better, good til

cancel... but delay the email to subscribers (and

the trade itself) until 3 minutes from now. |

|

|

|

Your program calls the following URL

(all on one line): |

|

|

http://www.collective2

.com/cgi-perl/

signal.

mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&delay=180 |

|

Note that 180 seconds is three minutes.

Delays and Emails To Subscribers

If you don't specify any delay, then trading signal

emails will be delivered immediately to your subscribers, and

trades themselves will be processed immediately (if the market

is open. Otherwise, the trade will be processed

when the market opens.)

On the other hand, if you specify a delay parameter, then

a signal will not be emailed immediately.

However, as soon as the first delay expires, then all

pending signals will be emailed to subscribers, all at once.

This is true, even if you have set individual delays for

subsequent trading signals.

This is not exactly obvious or intuitive, so let me try

to explain it in programming terms. Imagine there is a

routine called "sendAllPendingEmailsToSubscribers."

Normally, this routine gets called as soon as one trading

signal is entered. However, if you specify a delay=

parameter, then this routine is not called right away, but

is instead scheduled for a time in the future.

However, once the routine is executed, it emails all

trading signals which have not been sent yet. It doesn't

matter what individual delays you specified as you entered

each of these trading signals. The delay= parameter,

then, specifies the delay for scheduling the

sendAllPendingEmailsToSubscribers() routine. And that

routine simply packages up all pending trading signals,

creates an email containing them, and sends it to your

subscribers; it doesn't bother with worrying about delays or

schedules.

The point is that you should anticipate in advance of

entering your first trading signal when you will want all

subsequent signals emailed to subscribers. When you enter

your first signal in a given batch, specify the appropriate

delay. This will keep the sendAllPendingEmailsToSubscribers()

routine from being called until this delay has elapsed.

Thereafter, you must keep specifying a delay as you enter

more signals - to prevent the

sendAllPendingEmailsToSubscribers() routine from being

called until you are ready to have your emails sent to

subscribers. Your emails to subscribers will be sent at the

earlier of the following:

(1) When your earliest delay time expires

or

(2) The first time you specify a trading signal with no

delay

Canceling Orders

To cancel an order, simply issue a command like this:

http://www.collective2 .com/cgi-perl/signal. mpl

?cmd=cancel&signalid=XXX&systemid=123&pw=abcd

You can issue a blanket cancellation of all pending

orders for a trading system like this:

http://www.collective2 .com/cgi-perl/signal. mpl

?cmd=cancelallpending&systemid=123&pw=abcd

Add an optional &cancelparked=1 parameter to the above, to also cancel any unexecuted orders that have been parked.

Flushing signals

You can instruct the system to immediately process all

pending trade signals, despite any delays you have specified

earlier, by using the following command:

http://www.collective2 .com/cgi-perl/signal. mpl

?cmd=flushpendingsignals&systemid=123&pw=abcd

This overrides the earlier delays and insists that orders

get processed as soon as possible.

Time-based orders

You can schedule an order to become valid at a certain

time. Time is specified as the UNIX epoch time, that is, the

number of seconds since the UNIX epoch. This number is

available as function time within perl and is also available

through other programming languages. Use it like this:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&parkuntil=TIMEINSECS

You can also specify the time you want the order to

automatically cancel (if not filled). This is also specified

in UNIX time, like so:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&cancelsat=TIMEINSECS

Or, alternately, if you do not want to specify a clock

time at which the order cancels, you can instead specify a

"relative time" at which the order cancels. This

is number of seconds after the order has been submitted that

you wish the order to automatically cancel. For example, if

you want to make an order cancel automatically (if not

filled) 10 minutes after submitting it:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&cancelsatrelative=600

No need for date calculations: use

parkuntildatetime

Finally, if you don't want to deal with Unix

timestamps, you can park orders until a specific date and

time using parkuntildatetime=YYYYMMDDhhmmss

Example: You want to park an order until June 18, 2006 at

09:31:15 in the morning:

http://www.collective2 .com/cgi-perl/signal. mpl?cmd=signal&

systemid=1234&pw=abcd&instrument=future&action=BTO&quant=5&

symbol=@ESZ1&duration=GTC&parkuntildatetime=20060618093115

Note that all times are Eastern U.S. (New York City)

and use the 24-hr clock (4 pm is 16:00).

Closing all positions

You can instruct the system to close all

open positions. This will issue a set of closing orders, at

market, for any position you have open. You might want to

issue this at the end of the trading day, to make sure you

are flat before the markets close. If you have no positions

open, the command will be ignored:

http://www.collective2 .com/cgi-perl/signal.

mpl

?cmd=closeallpositions&systemid=123&pw=abcd

Changing stop and limits (the xreplace command)

C2 doesn't support automatic trailing stops (or trailing profit targets). This means you'll need to issue your stop loss, and then, as time passes, do a cancel-and-replace (xreplace) on it in order to change the trigger price. Let's look at an example of how to do this.

First, you place your original order:

http://www.collective2.com/cgi-perl/signal.mpl?cmd=signal&systemid=12345

&pw=mypassword&instrument=forex&action=BTO&quant=1&symbol=USDJPY

&duration=GTC&stoploss=101.90

Notice that I'm placing an "all-in-one" order: that is, an entry to go long at the market, plus my original stop loss (set at 101.90).

C2 responds with some ugly XML:

<collective2>

<ack>Signal Received</ack>

<status>OK</status>

<signalid>35584023</signalid>

<comments>Signal 35584023 accepted for immediate processing.</comments>

<oca></oca>

<delay></delay>

<stoplosssignalid>35584025</stoplosssignalid>

</collective2>

You'll want to parse out the <stoplosssignalid> tag, because you'll need it when it's time to change your stop loss.

How do we do it? Well, let's imagine you want to modify your stop loss to 101.80. You would:

http://www.collective2.com/cgi-perl/signal.mpl?cmd=signal&systemid=12345

&pw=mypassword&instrument=forex&action=STC&quant=1&symbol=eurusd

&duration=GTC&xreplace=35584025&stop=101.80

You can see that basically, I'm entering a new STC @ stop 101.80 order... but I'm specifying to first cancel signalid 35584025 (by using the xreplace=35584025 parameter).

C2 responds:

<collective2>

<ack>Signal Received</ack>

<status>OK</status>

<signalid>35584086</signalid>

Signal 35584086 accepted for immediate processing.</comments>

<oca></oca>

<delay></delay>

</collective2>

Requesting Buying Power

Some trading systems may vary the quantity

of the trades they place, or decide to take certain actions

such as canceling pending orders, depending on the amount of

"buying power" they have left. When your Buying

Power goes down to zero, Collective2 will issue a margin

call, and may begin to close any of your open in any order

it deems appropriate.

To request information about a particular

trading system's buying power, do this:

http://www.collective2 .com/cgi-perl/signal.

mpl

?cmd=getbuypower&systemid=123&pw=abcd

The response you receive back will look like

this:

<collective2>

<status>OK</status>

<calctime>1136058468</calctime>

<buypower>68300.00</buypower>

</collective2>

Buying power is recalculated every ten

minutes, or when a trade is opened or closed. The calctime

in the XML above is the Unix timestamp (seconds since the

beginning of the Unix epoch) when the buying power was

last calculated. In other words, there is no point in

requesting buying power more frequently than once every

ten minutes (or after a trade is executed).

The command called signalstatus

allows you to request the up-to-date status of a C2 order.

In other words, if you know a signalid, you can find

out whether a signal has been filled on C2's Hypothetical

Fill Engine, and at what price. You may also learn that the

signal has been canceled or has expired.

The requestor needs either to be the owner of the system in

question, or a subscriber to the system. You identify

yourself by passing the usual pw=c2password

parameter, but also -- and this part is new -- you must pass

the email address you use to login to C2. This last

parameter is necessary because this particular command does

not require you to specify which systemid you are

requesting information for. All that is necessary is the signalid.

Here's an example of how to call the command:

The response might look like this:

<collective2>

<signal>

<signalid>20919494</signalid>

<systemname>Velocity Forex System</systemname>

<postedwhen>2006-05-19 15:34:50:000</postedwhen>

<emailedwhen>2006-05-19 15:45:28:000</emailedwhen>

<killedwhen>0</killedwhen>

<tradedwhen>2006-05-19 22:08:53:000</tradedwhen>

<tradprice>20.87</tradeprice>

</signal>

</collective2>

Note that all times are Eastern U.S. time. A time field of

zero means it never happened (i.e. if "killedwhen"

is zero, then the signal never was killed/canceled).

Of course, for the command to be useful you must know the

signalid. Remember that you can specify your own signalids

when placing orders, or you can extract a C2-assigned

signalid if you do not use your own numbering scheme.

This command should help developers create order entry and

order-tracking applications. Keep in mind that this command

is not designed for AutoTrading use. It's a light-weight

command that simply reports order status on C2. It does not

determine whether a user should place a trade, or at what

quantities.

For AutoTrade development, be sure you look at the C2ATI

instead of the Trade Placement API (see below).

Update:

June 4, 2007

To answer a user request, we now allow your

API call for signalstatus to request more detailed

information. There are two new parameters you can use with

signalstatus. You can choose to use either, both, or

neither. Omitting both parameters means the data returned

will be exactly as above; this allows older software to

remain compatible.

The new parameters are:

&showrelated=[children|parent]

and

&showdetails=1

The first parameter specifies whether you

want C2 to return information about related signals. If you

specify &showrelated=children, then C2 will include

information about all orders that are conditional upon the

specified order. This is useful if you know an entry order's

signal id, but want to request information about related

stop-loss or profit-target orders.

The &showdetails=1 parameter tells C2

that you want C2 to return extended information about each

signal. This includes the buy/sell information, time in

force (TIF), stop, limit, quantity, and symbol.

An example will help demonstrate.

You call:

C2 responds:

<collective2>

<signal>

<signalid>26618011</signalid>

<systemname>Absolute Returns</systemname>

<postedwhen>2007-06-04 13:04:32:000</postedwhen>

<emailedwhen>2007-06-04 13:04:40:000</emailedwhen>

<killedwhen>0</killedwhen>

<expiredwhen>2007-06-04 16:18:09:000</expiredwhen>

<tradedwhen>0</tradedwhen>

<tradeprice>0</tradeprice>

<action>BTO</action>

<quant>100</quant>

<symbol>AAPL</symbol>

<limit>10.25</limit>

<stop>0</stop>

<market>0</market>

<tif>DAY</tif>

<ocagroupid></ocagroupid>

<child>

<signal>

<signalid>26618014</signalid>

<systemname>Absolute Returns</systemname>

<postedwhen>2007-06-04 13:04:32:000</postedwhen>

<emailedwhen>2007-06-04 13:04:40:000</emailedwhen>

<killedwhen>2007-06-04 18:53:25:000</killedwhen>

<expiredwhen>0</expiredwhen>

<tradedwhen>0</tradedwhen>

<tradeprice>0</tradeprice>

<action>STC</action>

<quant>100</quant>

<symbol>AAPL</symbol>

<limit>99.99</limit>

<stop>0</stop>

<market>0</market>

<tif>GTC</tif>

<ocagroupid></ocagroupid>

</signal>

</child>

<child>

<signal>

<signalid>26618016</signalid>

<systemname>Absolute Returns</systemname>

<postedwhen>2007-06-04 13:04:32:000</postedwhen>

<emailedwhen>2007-06-04 13:04:40:000</emailedwhen>

<killedwhen>2007-06-04 18:53:25:000</killedwhen>

<expiredwhen>0</expiredwhen>

<tradedwhen>0</tradedwhen>

<tradeprice>0</tradeprice>

<action>STC</action>

<quant>100</quant>

<symbol>AAPL</symbol>

<limit>0</limit>

<stop>7.5</stop>

<market>0</market>

<tif>GTC</tif>

<ocagroupid>1234</ocagroupid>

</signal>

</child>

</signal>

</collective2>

Essentially, in the response above, C2 is

telling you that signal id 26618011 is an order to BTO 100

shares of AAPL at 10.25 limit. There are two conditional

orders (children) attached to it. They are signals 26618014

and 26618016, and they are respectively a profit target of

99.99 (limit order) and stop loss of 7.5. Both conditionals

are GTC.

Update:

October 31, 2007

When you request signalstatus and

showdetails=1, C2 will return a field called <ocagroupid>xxx</ocagroupid>.

xxx is the OCA (one-cancels-all) group id which the signal

is a part of. If the signal is not part of a still-valid OCA

group, xxx will be blank.

The command called positionstatus

allows you to request the up-to-date status of a C2 position

for any given symbol. This is not meant to be used for

AutoTrading, since it displays only the C2 "model

account's" position. There is no reference to any

real-life brokerage account, nor any scaling calculations.

For true AutoTrade development, be sure you look at the C2ATI

instead of the Trade Placement API (see below).

To use the positionstatus command, you need

to specify a systemid and a symbol:

Responses look like this:

<collective2>

<status>OK</status>

<positionstatus>

<calctime>2006-09-11 10:40:35:000</calctime>

<symbol>EURUSD</symbol>

<position>4</position>

</positionstatus>

</collective2>

In the <position> field, a positive

number means a long position, and negative means a short

position.

The command allsystems returns

a list of the trading systems "owned" by a

particular C2 user. Please note that the list returns only

the trading systems started by the customer -- not the

systems subscribed to by the customer.

To use the allsystems command, you need

to specify C2 user login information like this:

Responses look like this:

<collective2>

<status>ok</status>

<errortype></errortype>

<comment></comment>

<systemsowned>

<system>

<systemid>13262198</systemid>

<systemname>X

System</systemname>

</system>

<system>

<systemid>11138919</systemid>

<systemname>Velocity

X</systemname>

</system>

<system>

<systemid>19308448</systemid>

<systemname>Lotsa

Forex</systemname>

</system>

<system>

<systemid>19472734</systemid>

<systemname>Forex

Tiger</systemname>

</system>

<system>

<systemid>22892798</systemid>

<systemname>Raptor

FX</systemname>

</system>

</systemsowned>

</collective2>

If no systems are "owned" by the user in question,

an error is returned like this:

<collective2>

<status>error</status>

<errortype>No systems owned</errortype>

<comment></comment>

</collective2>

The command called getsystemhypothetical

(getsystemhypo

also accepted) allows you to request equity information

about trading systems on Collective2. Important: the data

returned reveals Collective2's hypothetical

system account information. The data does not include any

customer/brokerage real-life account data.

Here is an example function call:

You can request between one and 25 systems at a time.

Demarcate each systemid using the period (.), as the example

above shows.

Data is returned as in the format below. Most likely, you

will be interested only in the 'totalequityavail' field.

You'll notice that totalequityavail equals cash plus

equity minus marginused.

<collective2>

<hypotheticalEquity>

<system>

<systemid>13889808</systemid>

<systemid>Absolute

Returns</systemid>

<totalequityavail>48281.90</totalequityavail>

<cash>101864.90</cash>

<equity>-8863</equity>

<marginused>44720</marginused>

</system>

<system>

<systemid>13202557</systemid>

<systemid>extreme-os</systemid>

<totalequityavail>218505.23</totalequityavail>

<cash>226803.23</cash>

<equity>894200</equity>

<marginused>902498</marginused>

</system>

</hypotheticalEquity>

</collective2>

The command getallsignals returns

a list of all signalids which are pending, for all systems

to which a user has access. This command was originally

found in the C2ATI (and is still available through that

separate API) but at least one developer requested that the

same command also be made available here in the order

placement API.

The command simply returns a list of

signalids, organized by system. All signalsids are pending

-- that is, they have neither been filled, canceled, nor

expired.

To use the getallsignals command, you need

to specify C2 user login information like this:

Responses look like this:

<collective2>

<status>OK</status>

<allPendingSignals>

<system>

<systemid>13262198</systemid>

<pendingblock>

</pendingblock>

</system>

<system>

<systemid>11138919</systemid>

<pendingblock>

</pendingblock>

</system>

<system>

<systemid>12627477</systemid>

<pendingblock>

<signalid>26123758</signalid>

</pendingblock>

</system>

<system>

<systemid>12646748</systemid>

<pendingblock>

</pendingblock>

</system>

<system>

<systemid>15816213</systemid>

<pendingblock>

<signalid>26990089</signalid>

<signalid>27176705</signalid>

<signalid>27176730</signalid>

<signalid>27192490</signalid>

<signalid>27229357</signalid>

<signalid>27229363</signalid>

<signalid>27271727</signalid>

<signalid>27431975</signalid>

<signalid>27567130</signalid>

<signalid>27621823</signalid>

<signalid>27621827</signalid>

<signalid>27621830</signalid>

<signalid>27621833</signalid>

<signalid>27621836</signalid>

<signalid>27621839</signalid>

<signalid>27621842</signalid>

<signalid>27621845</signalid>

<signalid>27621848</signalid>

<signalid>27621851</signalid>

<signalid>27621856</signalid>

<signalid>27621859</signalid>

<signalid>27621945</signalid>

<signalid>27621949</signalid>

<signalid>27621952</signalid>

<signalid>27621955</signalid>

<signalid>27621959</signalid>

<signalid>27621963</signalid>

</pendingblock>

</system>

</allPendingSignals>

</collective2>

The command addtoocagroup will add an

already-existing signal into an already-existing ocagroup.

This function is not meant to be used to create a brand new

ocagroup.

To use the addtoocagroup command, you need

to specify C2 user login information like this:

Responses look like this:

<collective2>

<status>OK</status>

<details>Signal 12345 now added to ocagroup

9876</details>

</collective2>

The newcomment

command (using the signal comment field to store

information)

Some C2 software developers have

begun to use the <comment> field to store internal

program state information. This wasn't what the field was

originally intended for, but it is ingenious. To aid these

efforts, we have added a new API command called newcomment.

You call it with a particular signalid and it overwrites the

commentary field for that signal. Only system owners have

permission to do this, obviously. You should be aware that

once a signal has been emailed to subscribers, if you change

the comment field, email subscribers will NOT receive the

new commentary, although it will be visible to ITM

subscribers or to anyone visiting the system page on the C2

Web site who turns on "show comments." Given that

the newcomment command is really meant only to store

internal state information for your application, this is not

necessarily a limitation. Here's an example of how to use

the newcomment field:

(Comment text must be URL

encoded.)

<collective2>

<status>OK: Signal

29148580 comment created</status>

<signalid> 29148580</signalid>

<previousComment></previousComment>

</collective2>

The previousComment field will

contain the comment text you are overwriting. This will be

URL Encoded.

Example

of using various API calls

Here is an example of how you

can submit orders, get information about them, and use the

comment field to store information internal to your

application.

First, we place an entry order

with an associated stop loss and profit target.

Response:

<collective2>

<signalid>29148577</signalid>

<comments>Signal 29148577 accepted for

immediate processing.</comments>

<oca></oca>

<delay></delay>

<profittargetsignalid>29148580</profittargetsignalid>

<stoplosssignalid>29148580</stoplosssignalid>

<autoOCAgroupid>29148580</autoOCAgroupid>

</collective2>

Note that the signal IDs have

been assigned for us. Since there are 2 children orders

(stop loss and profit target), they are made into an OCA

group (one cancels another). This means that if either is

filled or cancelled, the other order will be canceled and

will not be left "hanging." If you prefer to

manage you own OCA groups, you can prevent an autoOCAgroupID

from being assigned by adding a &forcenooca=1

parameter to the cmd=signal call. This may be preferable

because it will allow you to change stop losses (by

canceling the stop loss and then submitting a new order)

without affecting the profit-target order, or vice-versa.

Now let's look at the signals

that are pending for a particular user. The getallsignals

command will return the signals that are pending for a given

C2 customer. If I am subscribed to 10 systems, when I send

my email/password combination, I will receive a list of 20

nodes, one for each system. System developers/owners are

treated automatically as subscribers to their own systems,

even if they do not formally subscribe on C2.

http://www.collective2.com/cgi-perl/signal.mpl?c2email=MYEMAIL&pw=PASSWORD&cmd=getallsignals

<collective2>

<status>OK</status>

<allPendingSignals>

<system>

<systemid>13889808</systemid>

<pendingblock>

<signalid>29148580</signalid>

<signalid>29148582</signalid>

<signalid>29148577</signalid>

</pendingblock>

</system>

</allPendingSignals>

</collective2>

One can imagine writing an app

which will cycle through the appropriate signalids above,

requesting more information using the signalstatus

command. Here is an example request.

<collective2>

<signal>

<signalid>29148580</signalid>

<systemname>Absolute Returns</systemname>

<postedwhen>2007-11-13 09:36:18:000</postedwhen>

<emailedwhen>2007-11-13 09:36:55:000</emailedwhen>

<killedwhen>0</killedwhen>

<expiredwhen>0</expiredwhen>

<tradedwhen>0</tradedwhen>

<tradeprice>0</tradeprice>

<action>STC</action>

<quant>10</quant>

<symbol>@ESZ7</symbol>

<limit>1400</limit>

<stop>0</stop>

<market>0</market>

<tif>GTC</tif>

<ocagroupid>29148579</ocagroupid>

<comment></comment>

</signal>

</collective2>

The command called minbuypower lets you set via the API the same setting that you can control via the Edit System Details screen when you are the administrator of a trading system. Here is how we describe this setting on that screen:

Some systems issue a flurry of opening orders at the beginning of the day (that is, orders to enter positions), then wait to see which will get filled, and then cancel the remaining orders when a sufficient amount of "buying power" has been used. We can help you implement this kind of strategy. Below, you can tell C2 to cancel all pending opening orders when your system buying power drops below a certain dollar-value threshold. Orders "to close" positions will not be affected. If you don't understand this paragraph, you probably don't want to use this feature.

Some users have requested that this setting be changeable via the signal API. To meet these requests, we allow you to change this value like this:

Please be aware that, regardless of whether you use the API to set this value or the manual Edit System Details page, this parameter is a best-efforts setting, and C2 cannot guarantee that your buy power level will be calculated and recognized instantly, or that all signals will be canceled speedily. But, overall, the function is pretty reliable, and some system developers do find it useful.

Use the API to send a message to all your subscribers. From the subscribers' perspective, this will appear exactly as it would if you used the Subscriber Broadcast feature available from your system page. Messages need to be short enough to fit in a single URL address, and must be URL Encoded. An example of this function's use:

http://www.collective2.com/cgi-perl/signal.mpl?cmd=sendSubscriberBroadcast&systemid=1234&pw=C2_Password

&c2email=Your_C2_login_email&message=The%20S%26P%20is%20a%20useful

%20instrument%20%3Cb%3Ebut%3C%2Fb%3E%20only

%20somewhat%20So%20%22Forget%22%20it.

Requests the total C2 Model Account equity of a system. This will return the most recent data point on the system equity chart. Or, more technically speaking, it will return the value of this equation: cash + value of positions currently held (marked-to-market).

http://www.collective2.com/cgi-perl/signal.mpl?cmd=getsystemequity&systemid=1234&pw=C2_Password

&c2email=Your_C2_login_email

For stock orders only, you may choose to submit your order quantity by dollar value instead of number of shares. Instead of using &quant= you may use &dollars=. For stock orders only, you may choose to submit your order quantity by dollar value instead of number of shares. Instead of using &quant= you may use &dollars=.

Note that prices may be delayed, and that the last price at the time of the order submission will be used. In other words, if you submit an order while the market

is closed, the previous day's last price will be used to translate the dollar value you specify into the number of shares. The next day's opening price will not be used.

For stock orders only, you may choose to submit your order quantity as a percentage of account value. Instead of using &quant= you may use &accountpercent=. For stock orders only, you may choose to submit your order quantity as a percentage of account value. Instead of using &quant= you may use &accountpercent=.

Use a number between 1 and 100. For example, the parameter &accountpercent=50 means you want to use 50% of your account value. The account value used (essentially, the most recent Y-axis value of your system equity chart) may be delayed. Then, once that account value number is determined, it is translated into a dollar-value of the amount of shares you want to buy/sell. At this point, the same limitations described n the paragraph above will apply: the last price at the time of the order submission will be used.

Also available: C2 AutoTrading API (C2ATI)

As you can see, the API described on this page describes

how to place trades and trading-related instructions into

C2. If you are interested in pulling trading information out

of C2 (for example, if you want to write software which

interfaces to a broker and then places certain

C2-recommended trades automatically), please contact Collective Help Desk

and ask for more information on the C2 AutoTrading

Interface.

Also available: C2 Data Services API (C2DS)

If you are interested in automating analysis of or interaction with C2 Trading Systems, you should look at our C2 Data Services API.

|