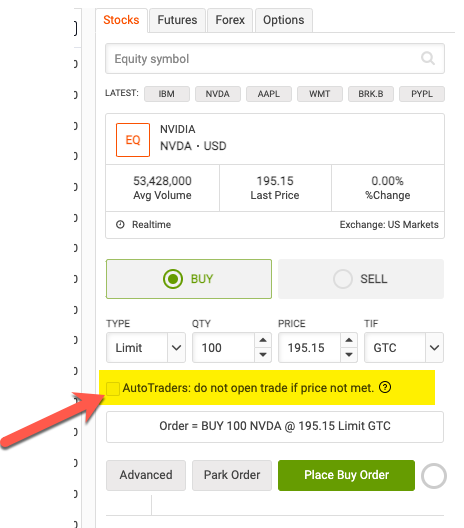

What is: "AutoTraders: do not open trade if price not met"

"AutoTraders: do not open trade if price not met" is available in WebTrader, when you enter Limit orders to open a new position.

Usually, when you have AutoTraders following your strategy, Collective2 insists that all AutoTraders follow all trades, at virtually the same time. That is what subscribers pay for, after all -- to follow your Model Account as soon as positions appear inside it.

The way this works in practice for "limit orders" is as follows. When one subscriber receives a fill, Collective2 will wait a few seconds for other subscribers to receive the same fill, and then -- after an interval -- convert the remaining limit orders which have not yet filled to "market" orders, so that subscribers stay "in sync" with a strategy's Model Account.

Typically, this works well. First of all, most limit orders "trade through" the limit price (i.e. go below it, in cases of buys; go above it, in cases of sells). By definition, when a limit order "trades through," every account that has submitted that limit price must fill.

However, there are cases when this method of keeping your subscribers in sync with your Model Account is not ideal. For example, in illiquid markets where there simply isn't much trading volume, and where there are wide bid/ask spreads, such as equity options, this method can result in (for example) just one "lucky" subscriber filling the excellent limit price, while the rest of subscribers pay the bid/ask spread as they convert to market orders to join the trade.

Tell Collective2 not to force everyone to fill entry orders

As a new, experimental feature, we are allowing Strategy Managers to specify that their subscribers should not necessarily convert to a market order when one of their fellow subscribers receives a fill. This feature is available only for entry orders (e.g. Buy To Open, Sell to Open); and only for Limit orders.

If you select this option when submitting an entry order, this means in practice that perhaps only one or two subscribers will be lucky enough to follow your trade. The remaining subscribers will maintain a working limit order, hoping to join the trade at your limit price at a later date. This working limit order will be removed from their accounts when you close your position in the Model Account that they follow.

Other limitations

Choosing this option for a trade will create several limitations.

First, you can only have one working entry order for any symbol where you have a working "do not open trade if price not met" order.

Second: you will not be able to "leg into" or "leg out of" your position. In other words, for any positions created using this kind of trade, you will not be able to gradually increase position size, or gradually decrease it. Once a position is opened using this special feature, you can only close 100% of it. If you desire another quantity, you can close the position and then start again. Keep in mind this limitation is in place only for positions created with this "do not open trade if price not met" feature.

Enjoy!